Trump’s Tariffs: A Global Trade Reckoning Unfolds in 2025

As of April 10, 2025, the global economic landscape is reeling from an unprecedented wave of tariffs imposed by U.S. President Donald Trump during his second term. Dubbed “Liberation Day” by Trump, this aggressive trade policy has ignited a firestorm of reactions, reshaping international relations, supply chains, and financial markets. This article delves into the key dates, diverse perspectives, retaliatory measures, market impacts, and the specifics of the 125% tariff and 90-day recess, offering a comprehensive overview of this pivotal moment in global trade.

Key Dates of Trump’s Tariff Rollout

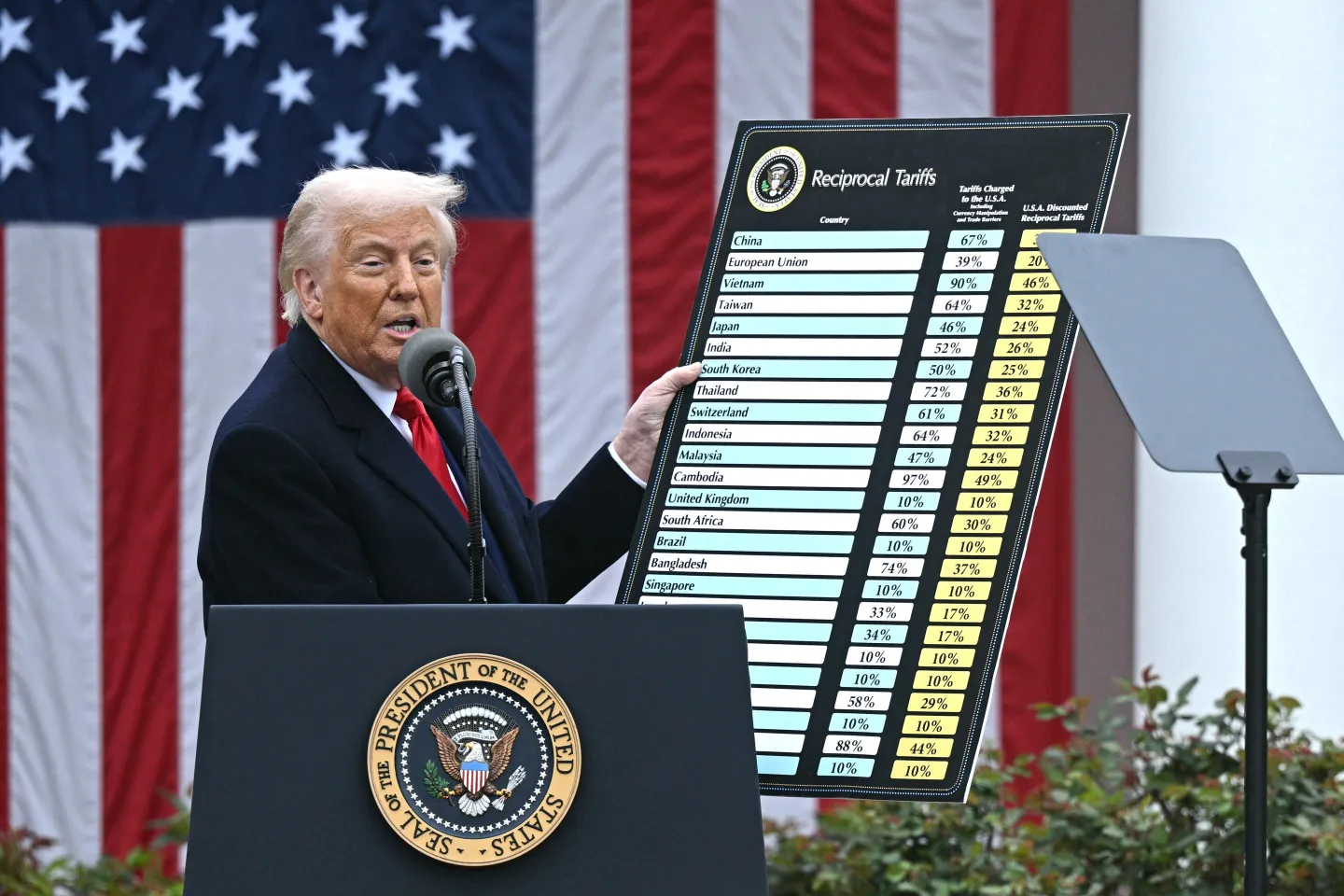

The tariff saga began on February 27, 2025, when Trump reaffirmed plans to address drug trafficking and illegal immigration, setting the stage for tariffs on Canada and Mexico, implemented on March 4, 2025. The broader policy crystallized on April 2, 2025, when Trump signed an executive order imposing a minimum 10% tariff on all U.S. imports, effective April 5, 2025, with higher “reciprocal” tariffs (11% to 50%) scheduled for April 9, 2025, targeting 57 countries. China faced an initial 34% reciprocal tariff on top of existing duties, raising the effective rate to 54%, announced on April 2, 2025, and effective April 9, 2025. Tensions escalated when Trump threatened a 50% additional tariff on April 7, 2025, unless China withdrew its 34% counter-tariff, leading to a hike to 125% on Chinese imports, effective April 9, 2025. A stunning reversal came on April 9, 2025, with a 90-day pause reducing tariffs to 10% for most countries (except China, Canada, and Mexico), while maintaining the 125% rate on China.

Perspectives on the Tariffs

- Donald Trump’s View: Trump frames these tariffs as a bold reclamation of American economic sovereignty. On April 2, 2025, he declared, “April 2, 2025, will forever be remembered as the day American industry was reborn,” arguing that decades of trade liberalization have “ripped off” the U.S. He sees the 125% tariff on China as leverage to force fair deals, stating on April 7, 2025, “Xi is a smart guy and we’ll end up making a very good deal.” Critics, however, question whether this protectionism risks inflation and recession, a narrative Trump dismisses as overblown, insisting it’s a strategic negotiation tool.

- Xi Jinping’s Perspective: China’s President Xi Jinping adopts a defiant stance, viewing Trump’s tariffs as economic bullying. On April 7, 2025, China’s commerce ministry labeled the 125% tariff a “mistake on top of a mistake,” vowing to “fight to the end” if pressured. Xi likely sees this as an opportunity to bolster China’s self-reliance, particularly in technology, though analysts suggest he may calculate that prolonged trade war costs could weaken China’s recovery, leaving room for negotiation despite public posturing.

- Europe’s Stance: The European Union, led by European Commission President Ursula von der Leyen, balances negotiation with retaliation. On April 9, 2025, von der Leyen offered a “zero-for-zero tariff” deal but warned of countermeasures, approving 25% tariffs on U.S. steel and aluminum effective April 15, 2025, targeting poultry, grains, clothing, and metals. French President Emmanuel Macron called it an “imperialist posture” on April 2, 2025, while Finland’s Foreign Minister Elina Valtonen urged zero tariffs, fearing a global recession. Europe’s dual approach reflects concern over U.S. unreliability and a desire to protect its €3.5 trillion trade network.

- India’s Position: India sees opportunity amid the chaos. With U.S.-China tensions, India’s “Make in India” initiative gained traction, attracting $15 billion in FDI by 2025 for semiconductors and electronics. On April 10, 2025, an official expressed intent to expedite a bilateral trade deal, leveraging the 90-day pause to double trade to $500 billion by 2030, as agreed with Trump on February 13, 2025. India avoids retaliation, focusing on export gains in agro-industrial goods, though it monitors U.S. policy shifts closely.

Singapore PM’s Statements on Trump’s Tariffs

Singapore’s Prime Minister Lawrence Wong has been vocal since the tariffs’ announcement. On April 8, 2025, addressing Parliament, he stated, “What the U.S. is doing now is not reform” and “it is rejecting the very system it created,” arguing that the 10% tariff on Singaporean goods “will accelerate the fracturing of the global economy.” Wong announced a national task force to support affected businesses and workers, emphasizing constructive engagement over retaliation. On the same day, his office confirmed no counter-tariffs, citing the U.S.-Singapore Free Trade Agreement, and pledged to pursue a Technology Safeguards Agreement to mitigate impacts, reflecting Singapore’s strategic balancing act.

Retaliations and Countermeasures: U.S. vs. China

The U.S.-China tariff war has unfolded in tit-for-tat escalations:

- U.S. Actions: Trump’s initial 10% baseline tariff on April 5, 2025, was followed by a 34% reciprocal tariff on Chinese goods on April 9, 2025, raising the effective rate to 54% (including prior 20% duties from 2024). On April 9, 2025, this surged to 125%, targeting electronics (e.g., smartphones, laptops), machinery, textiles, and consumer goods like toys and footwear. The closure of the de minimis loophole on May 2, 2025, imposes a 90% duty or $75 on packages under $800 (rising to $50 in June), hitting Chinese e-commerce giants Temu and Shein, which accounted for 60% of duty-free U.S. imports.

- China’s Retaliations: On April 4, 2025, China imposed a 34% tariff on all U.S. imports, effective April 10, 2025, targeting $21 billion in U.S. agricultural goods (e.g., soybeans, pork), energy products (coal, LNG), and vehicles. Additional measures include export curbs on rare earths (e.g., dysprosium, yttrium) and sanctions on 30 U.S. defense firms. On March 4, 2025, China hit $21 billion in U.S. agriculture with 10%-15% levies, suspending lumber imports and soybean licenses, signaling a strategic response to pressure U.S. farmers and manufacturers.

These measures reflect a deepening trade war, with U.S. imports from China—valued at $448 billion in 2025—facing severe disruption, while China counters with resource and market access restrictions.

Market Swings in Detail

Trump’s tariffs triggered dramatic market volatility. The April 2, 2025, announcement wiped out $5 trillion in S&P 500 value by April 5, 2025, with a 5% drop, the worst since March 2020. The Dow fell 4%, and Nasdaq declined 6%, driven by recession fears, oil price plunges, and bond market shifts. Asian markets followed, with Japan’s Nikkei dropping 10% on April 7, 2025, and China’s stocks falling until state intervention on April 8, 2025. The April 9, 2025, 90-day pause sparked a recovery, with the S&P 500 surging 9.5% and Japan’s Nikkei rising 9%, though $6 trillion in market value remained lost since April 5. Gold prices dipped, and the dollar rebounded, reflecting investor relief tempered by ongoing China concerns.

The 125% Tariff, 90-Day Recess, and 10% for Over 70 Countries

The centerpiece of Trump’s strategy is the 125% tariff on Chinese imports, effective April 9, 2025, escalating from 104% to counter China’s 34% retaliation. Simultaneously, a 90-day recess from April 9 to July 8, 2025, lowers tariffs to a 10% baseline for over 70 countries, excluding China, Canada, and Mexico, which retain higher rates (e.g., 25% for fentanyl-related goods). This pause aims to negotiate deals, with Treasury Secretary Scott Bessent citing leverage over China’s fentanyl trade. The policy spares 1,000 product categories (e.g., pharmaceuticals, semiconductors) but risks inflation, with Goldman Sachs lowering recession odds from 65% to 45% while warning of a 15% tariff rate increase.

Conclusion: The Future of Global Trade

As of April 10, 2025, Trump’s tariffs have fractured the post-war free trade consensus, pitting protectionism against global interdependence. The 125% tariff and 90-day recess signal a high-stakes gamble, with potential to reshuffle supply chains toward India and Vietnam, but also to deepen U.S.-China enmity. Europe’s measured response and Singapore’s diplomatic stance suggest a push for stability, while market swings underscore economic fragility. Looking to 2030, success hinges on negotiation outcomes—possibly a Trump-Xi deal—or escalation into a prolonged trade war, reshaping alliances and economic power in an increasingly multipolar world. Stakeholders must navigate this uncertainty with agility, as the global trade order hangs in the balance.